iPhone Cash-Out Service: The Process

iPhone Cash-Out Service: Ever stared at your sleek, beautiful iPhone and thought, “This device is incredible, but I wish it could instantly convert my future financial stability into a modest pile of cash right now? ” Well, hold onto your hats, financial daredevils, because you’re in luck! Welcome to the wild, wacky, and wonderfully perilous world of the iPhone Cash-Out Service.

This isn’t your grandfather’s responsible savings plan. Oh no. This is financial acrobatics without a safety net, a digital magic show where you are both the magician and the person being sawed in half. So, for educational and entertainment purposes only, let’s pull back the curtain on the step-by-step process of a typical iPhone Cash-Out Service. Buckle up.

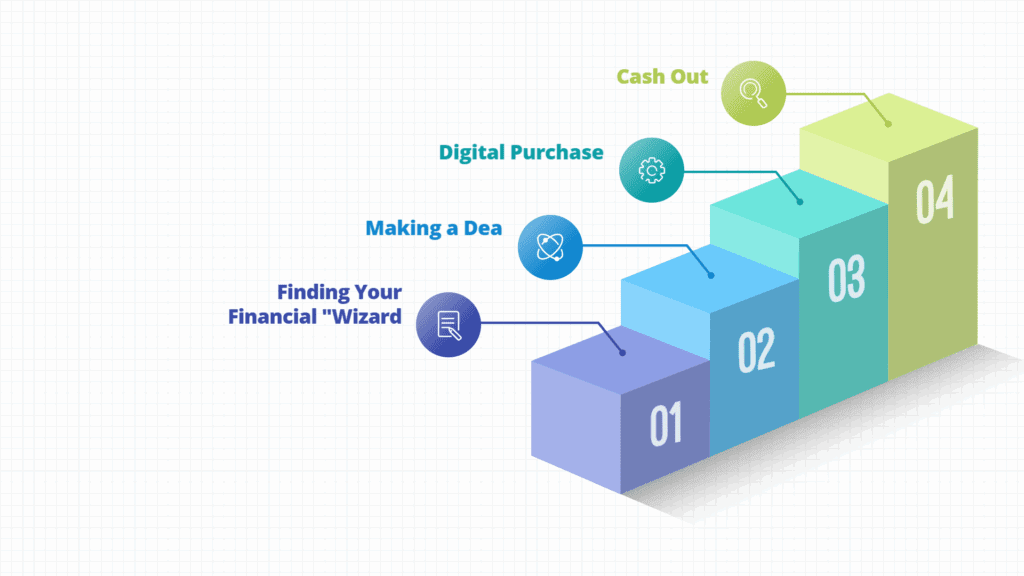

Step 1: The Desperate Scroll – Finding Your Financial “Wizard”

Our journey begins, as so many modern tragedies do, with a frantic late-night Google search. You, our protagonist, have a pressing need for cash. The reasons are unimportant; what matters is the urgency. You type in phrases like “instant cash” or “emergency money,” and after scrolling past the boring, legitimate options, you find it a blog post glowing like a beacon in the digital fog. It’s an article, written with the enthusiasm of someone who has just discovered free energy, about a fantastic 아이폰 콘텐츠이용료 현금화 iPhone Cash-Out Service.

These aren’t found in the phone book. You’ll find them lurking in the optimized jungles of search engines or advertised through anonymous social media accounts. They present themselves as a clever life-hack, a modern solution for modern problems. You’ll click a link, likely leading you to an anonymous chat app like KakaoTalk or Telegram, where you’ll meet your guide to this financial wonderland.

Step 2: The Reassuring Chat – Making a Deal with a Stranger

You are now in a one-on-one chat with your operator, a person whose entire business model relies on sounding more trustworthy than your own common sense. They are masters of reassurance.

You: “Hi, I saw your post about the iPhone Cash-Out Service. How does this work? Is it safe?”

The Operator: “Of course! 100% safe and secure! We’ve helped thousands of people just like you. The process is simple and takes less than 10 minutes. What’s your phone carrier?”

They will be polite, professional, and unnervingly calm. They’ll explain their fee structure, which is the financial equivalent of highway robbery but presented as a “modest commission.” They might offer you a 60% payout, meaning for every $100 you charge to your phone bill, you get a glorious $60 in cash. What a bargain! Convinced by this stranger’s impeccable manners, you agree to proceed. After all, they’ve helped thousands, right? This specific iPhone Cash-Out Service must be one of the good ones.

Step 3: The Digital Purchase – You’re Robbing Yourself Now

This is the main event, the core of this spectacular magic trick. The operator will give you a specific instruction. This is where the actual “cashing out” happens. They’ll typically use one of two methods:

- The Apple Gift Card Method: The operator will ask you to purchase a digital Apple Gift Card of a specific, high value directly from your iPhone. You’ll use your Apple ID, which is conveniently linked to your mobile carrier for billing. Once you have the code, you’ll send it to them. It’s simple, clean, and as irreversible as accidentally hitting “reply all” on an embarrassing email.

- The In-App Purchase Method: For a more exotic flavor, the operator might instruct you to download a popular mobile game and buy a large amount of its most valuable in-game currency think “Dragon Gems” or “Cosmic Diamonds.” You then transfer these digital shinies to an account they specify.

Now, a connoisseur of these financial arts might pause and ask about the 소액결제 현금화 vs 정보이용료 현금화 차이 (difference between micropayment cashing vs. content fee cashing). For our purposes on the App Store, it’s all one big, happy family of debt, usually billed through your carrier. Let’s not get bogged down in the semantics of our financial ruin, shall we? You’ve just made the purchase. You’ve taken the plunge. The iPhone Cash-Out Service is in full swing!

Step 4: The Vanishing Act – The Grand Finale

You’ve sent the gift card code or transferred the in-game items. You stare at your chat window, waiting for the promised bank transfer. The operator’s status is “online.” You see the three little dots that mean they’re typing. And then… nothing.

Poof!

Like a ghost in the machine, your friendly operator has vanished. Your messages no longer deliver. You’ve been blocked. This, my friends, is the grand finale, the “eat-and-run” scam. The operator has your valuable digital asset (the “eat”) and has promptly disappeared (the “run”). They have their money. You, unfortunately, do not. The iPhone Cash-Out Service experience has reached its thrilling climax. Some might call this fraud; others might call it a very expensive lesson in trust. This is the risk you take with any iPhone Cash-Out Service.

Step 5: The Aftermath – Your Souvenir Is a Giant Bill

But wait, the show isn’t over! There’s an encore. Roughly 30 days later, you’ll receive a souvenir from your adventure: your monthly phone bill. And on it, you will find the full, unadulterated charge for the digital goods you purchased. That $500 gift card you bought to get $300 in cash? You now owe the full $500, plus your regular phone charges.

When you inevitably can’t pay it, your mobile carrier will begin calling. Your service might get suspended. And as a final party favor, that delinquency will be reported to credit bureaus, savaging your credit score for years to come. Even worse, Apple, who takes a very dim view of their ecosystem being used as a black-market ATM, might permanently ban your Apple ID, taking all your purchased apps, movies, and music with it.

So there you have it. The step-by-step process of a typical iPhone Cash-Out Service. It’s a dazzling display of modern ingenuity that promises a quick fix but delivers a long-term financial catastrophe. The allure of an iPhone Cash-Out Service is strong, but the consequences are stronger. It’s a service that truly keeps on giving—giving you debt, regret, and a fantastic story to tell your credit counselor. And that’s why the best way to use an iPhone Cash-Out Service is to not use one at all.